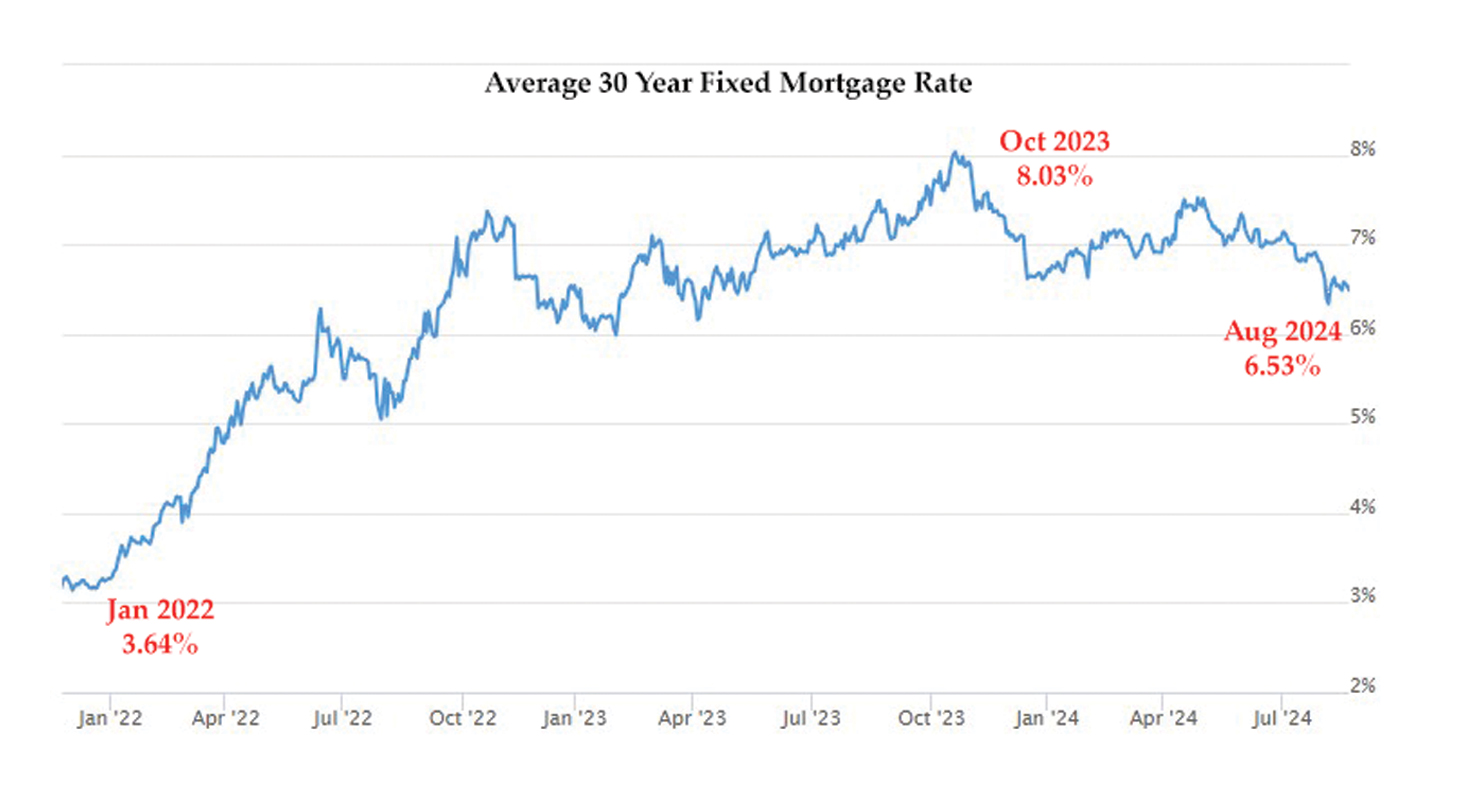

It’s been some time since I last wrote about interest rates in any detail, and with this being one of the major contributing factors to buyer demand and the overall direction of the housing market, I thought it would be a good time to address this again. The topic of interest rates has been a hot one for the last few years, and for good reason. Before we dive in too deep, let’s do a quick recap. The Federal Reserve, as a way of combating rising inflation, increased the Federal Funds Rate a whopping eleven times between March of 2022 and July of 2023. As a consequence, we saw mortgage interest rates soar from the mid-3% range in early 2022 all the way to over 8% by the end of 2023. This, of course, is one of the primary reasons we have seen such a slowing in the housing market, and it is why we have been watching rates so closely. There is a high likelihood that we could see the first rate cut as early as late September, and with this positive news among other factors, mortgage rates have begun trending down again, bringing some much needed relief to budget-conscious buyers. In fact, at the beginning of August, mortgage rates were at their lowest level since April of 2023, and have stabilized in the 6.5% range as of this writing.

With all of that mumbo-jumbo and the nerdy numbers out of the way, let’s talk about the impact on the everyday buyer and the numbers that people care the most about… the ones that affect the pocketbook. The reason the Federal Reserve increases rates is actually quite simple. The goal is to slow buyer demand, and therefore reduce the cost of goods and services. As rates increase, it is more expensive to borrow money, and a higher payment means people can afford less or may not even qualify to purchase at all. As a way of illustrating this, I wanted to provide you with some real life examples. Using a purchase price on a home of $500,000 with a 20% down payment, the mortgage amount would be $400,000. In January of 2022, the average 30 year fixed mortgage rate was 3.64%, and the principal and interest (PI) payment on this loan would have been $1,828. If this same $400,000 mortgage was financed in October of 2023 with an average 30 yr rate of 8.03%, the PI payment would have been $2,943, or an astonishing $1,115 more per month! Even at today’s relatively lower rates of 6.53%, the payment would still be considerably more expensive at $2,536. While prices have certainly come down in some areas, on average the Phoenix Metro area is actually more expensive than it was in the peak of 2022. It is easy to understand why so many buyers are waiting on the sidelines hoping that rates will come down to a more affordable level, given the high cost of housing.

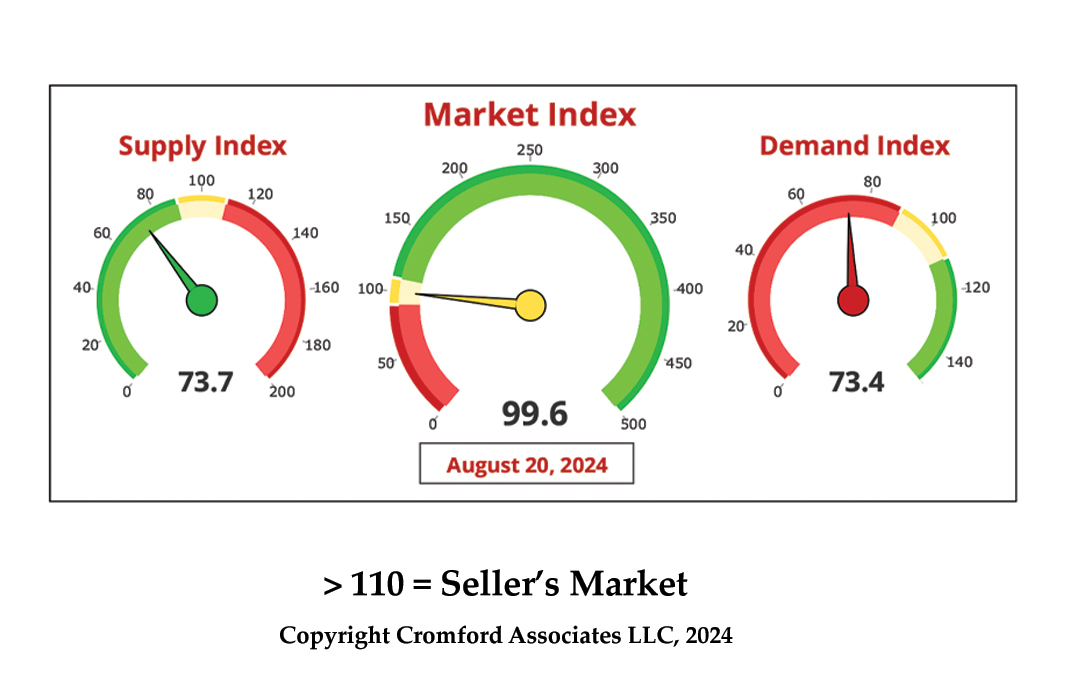

There still remains a tremendous amount of uncertainty in the market with the elections just around the corner and the overall state of the economy. Hope does appear to be on the horizon, however. As of 8/14, mortgage applications have risen nearly 17% over last year, and this is significant because applications often translate into active buyers. If this trend continues and demand increases, conditions could very well become more favorable to sellers in the coming months. This all, of course, remains to be seen, but we have already seen an increase in the market index for 8 of the 17 major cities that make up the Phoenix metro area. While we still have a ways to go to get back to a more normal market, there is good reason to be optimistic about the future here in Phoenix. If you’re considering selling your home anytime in the next few months and you’d like to talk about your specific situation, please give me a call. I’d love to talk nerdy with you :)