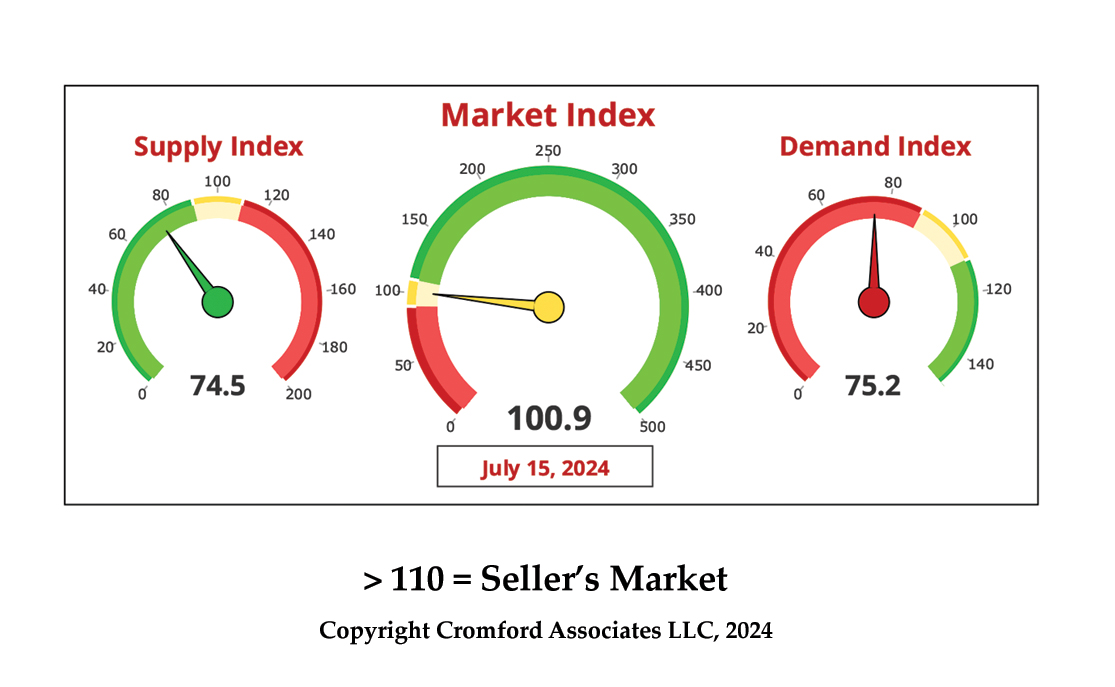

It’s time again to return to a regular topic in my market commentary, supply & demand. If you’ve been a reader of mine for any amount of time you’ll know that this is my most revisited topic, and for good reason. Understanding the balance of active sellers (supply) to active buyers (demand) is one of the most reliable and foundational pieces of data that we have. This information is key to helping us forecast our short and mid-term market trends, home values, and is pivotal to understanding which party has the upper-hand when negotiating offers. Every month I include the market index gauges at the lower right because this is a great visual to quickly understand the balance, even if it’s not the particular subject of my commentary.

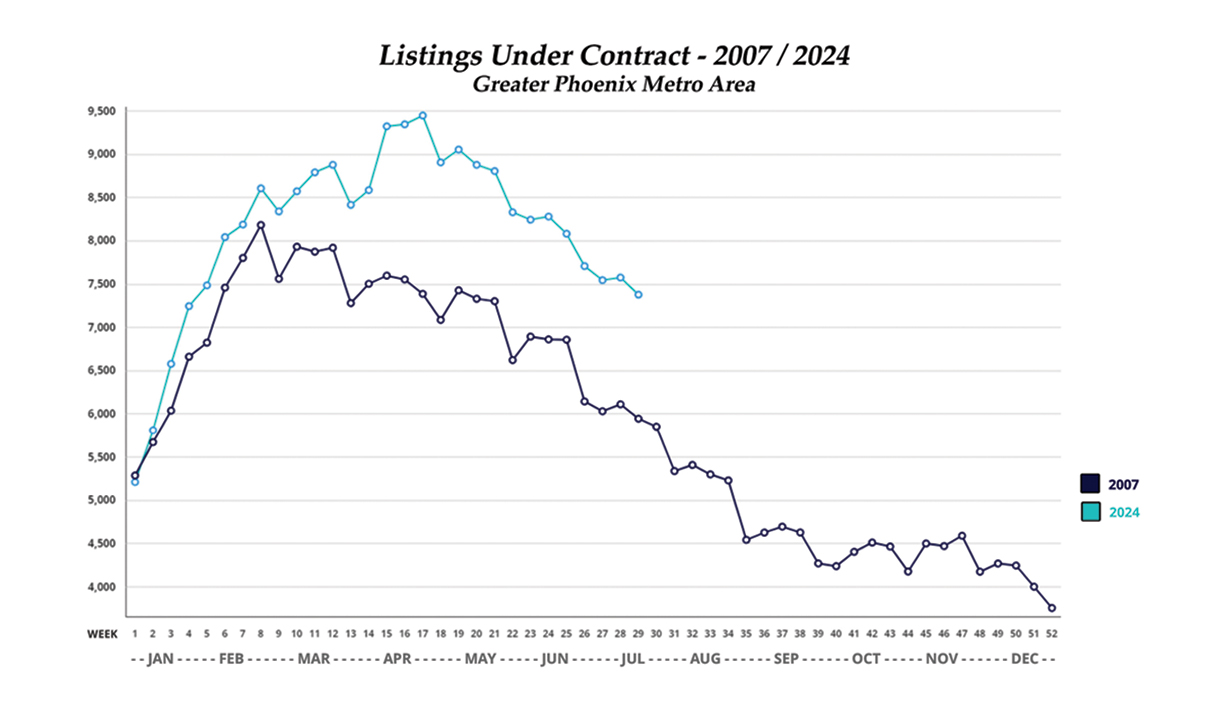

This month, I want to talk specifically about the demand side of the equation because this currently seems to be the most top-of-mind for most clients we talk to on both sides. When meeting with our sellers, many are concerned and want to know if now is really a good time to list their home because they question whether or not people are really still buying in this market, given the high interest rates and the uncertainty around the elections. When we’re talking with buyers, they want to know if now is really such a great time to buy and are looking for confirmation that they’re not making a poor decision by paying too much or buying before “another crash”. These are sensible questions and people are right to ask them. It is important to say that there are, indeed, far fewer buyers in the market today than we have seen in a very long time. In fact, we have to look all the way back to 2007 (see graph below) in the middle of the market crash to find a time with fewer homes under contract, which is one way we measure demand. With that said, however, there is one dramatic difference between 2007 and now, and that is the significant disparity in active listings (supply). To put it into context, in 2007 we had around 55,000 active listings in the Phoenix Metro, which is about double the amount of normal supply at that time. Today we have about 18,000, which is only about 75% of current normal supply levels. This is an important distinction and it brings us back to the topic of balance. As previously noted, demand is currently quite low, but so is supply and when both are equal, regardless of how high or low, this leads to stable home values. It is when the market is out of balance with greater supply than demand that causes values to decrease. To make it a bit easier when you look at the index each month, note that if the market index is above 110, values are very likely to increase in the mid-term future. If the index is below 90, values are likely to decrease. Between 90-110, we expect overall stability in home values. Again, the Market Index measures balance, regardless of volume.

So, why is it so important to keep beating this same drum? It is important for several reasons, but it is predominantly because the talk of an impending crash continues to be unfounded, and also because anyone that does decide to sell in this market should know that our market is stable, but it is also very quiet. This market requires quite a bit of patience. Homes ARE selling and are even in some areas of town increasing in value, but they are taking quite a bit longer to sell than what most people are used to. Some houses do, indeed, sell within a few days or weeks, but the majority are taking 60-90 days. The Federal Reserve has suggested that an interest rate reduction could happen as early as September, and this has the potential to lead to lower mortgage rates. If this happens, we could easily see a welcomed increase in demand. With that, so long as our supply levels remain at their current levels, we could quickly absorb the inventory and be back into a supply constricted market with increasing values. It’s impossible to predict what the next several months hold in store for us, but there is as much reason to be optimistic as anything. So, as always, if you’re considering selling your home anytime in the near future, please give me a call. I’d love to talk nerdy with you :)