It seems that each year when January arrives it feels just as wild as it did the last January… just like that and it’s another year gone by and we’re ready to start fresh. It’s the time for reflection about the previous 12 months and contemplation about the next 12 ahead. As I write this “Year in Review” edition of our newsletter each January, I try to think about the few key points that will best summarize the previous year's market, and to use that to try and forecast what may be in store for us as the new year progresses. As a way of helping me with that and in preparation to write this commentary, I first reviewed last year's forecast and found that I was more-or-less correct on some points and missed the mark on others. I wrote that home values would likely stay stable, which they did and even increased slightly, with the median sales price rising from $430k to $445k. With that, however, came the added cost of paying for more concessions to buyers like helping them buy down their interest rate and/or paying for other closing costs. I also said that sellers would need to be patient and expect 60-90 days on market, which was also true, but many have taken considerably longer. Lastly, I wrote that the Federal Reserve might lower rates the second half of the year, and they did (3 times, in fact), but mortgage rates are actually higher than they were last January. Despite this, demand rose a bit in 2024 but it was not enough to absorb the increasing supply.

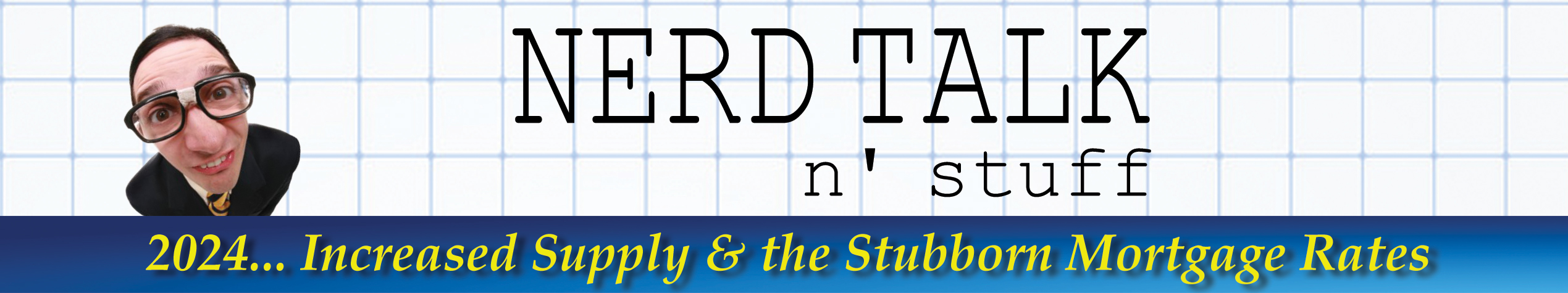

In reviewing this forecast I noted that the two key points that best summarize last year come back to supply & demand. First, we saw a considerable increase in supply with nearly 33% more inventory at the end of December than where we started in January. It’s helpful to understand where all of these listings came from, though. A significant portion of this increase was caused by accumulation rather than from a rush of new listings. Because homes are taking quite a bit longer to sell, the number of active listings accumulates as they sit and new listings are added on top. In addition, however, we did see an increase in the rate of new listings coming to market, particularly in the second half of the year. The reasons for this are not entirely clear but the trend continued well into November when we would normally see the listing count drop. Interestingly, however, nearly 1,150 listings were pulled from the market the last week of the year, which is more than double what we saw in 2023. This could mean that those sellers became discouraged and decided not to sell, or more likely, it could mean that they want their days on market to reset and try again, and will relist their home in a few months. As I said above, our starting point for active listings in 2025 is quite a bit higher than it was last year, so as the spring selling season begins, the thing to watch will be the amount of new listings being added to the market. With “New Year Optimism”, we could easily see new supply outpace the already fledgling demand and tip us into a full-blown buyer’s market.

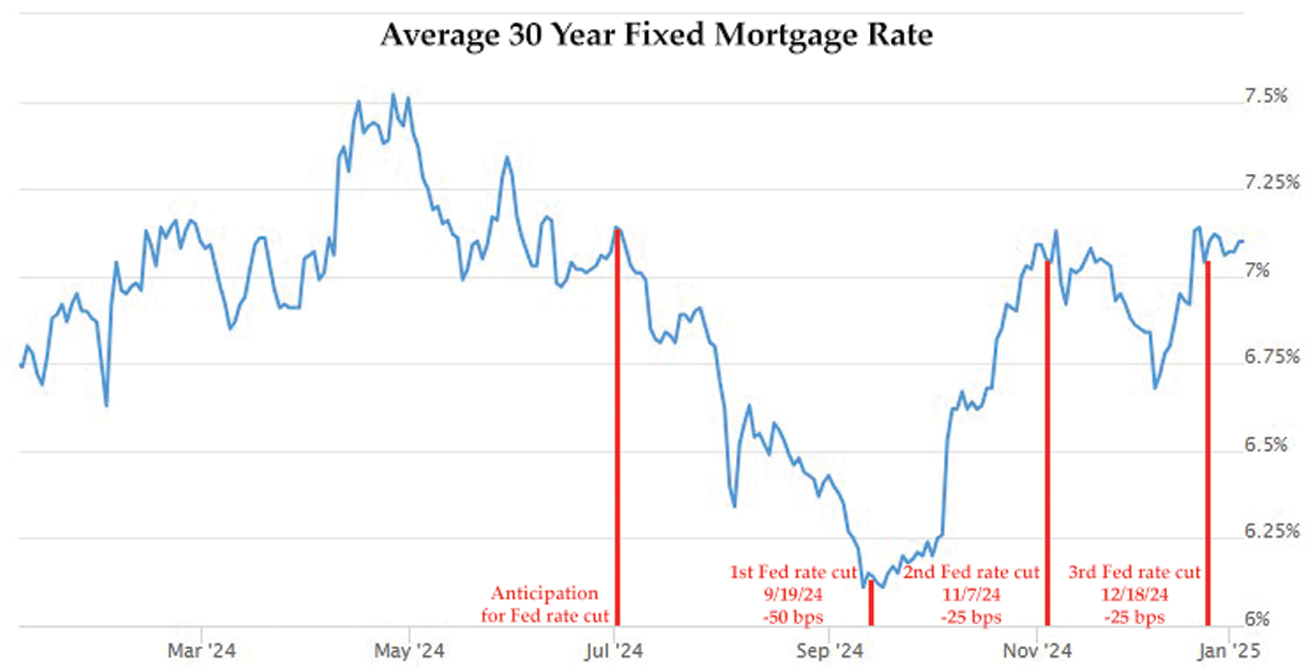

This now leads us to point number two, which is the stubbornly high mortgage rates… and not to be confused with the Fed Rate. Again, the Fed reduced the rate 3 times last year, but the mortgage rates still remain above 7%. The significantly higher rate environment we’ve experienced over the last few years is very understandably one of the primary reasons demand has taken such a hit. As we can clearly see, the rate set by the Federal Reserve is only one piece of the complex nature of what determines the mortgage rate, and hence the reasons why it is so difficult to forecast with any level of accuracy. In saying that, it is unlikely that buyers will come back into the game in any meaningful way until the mortgage rates come down and stay down. It shouldn’t be expected that we’ll see 3% or even 4%, but if rates settle in the 5-6% range, I think we’ll begin to see buyers get excited again. As we continue into 2025, I will continue to watch and report on supply & demand as I usually do, and will refrain from making any big predictions too far into the future. 2025 has the potential to be a great rebounding market, but the broader economy plays a big part in that and only time will tell how this all shakes out as the year progresses. So as for you and your house… if you are considering making a move this year and would like to talk about your specific situation, please give me a call. I’d love to talk nerdy with you :)