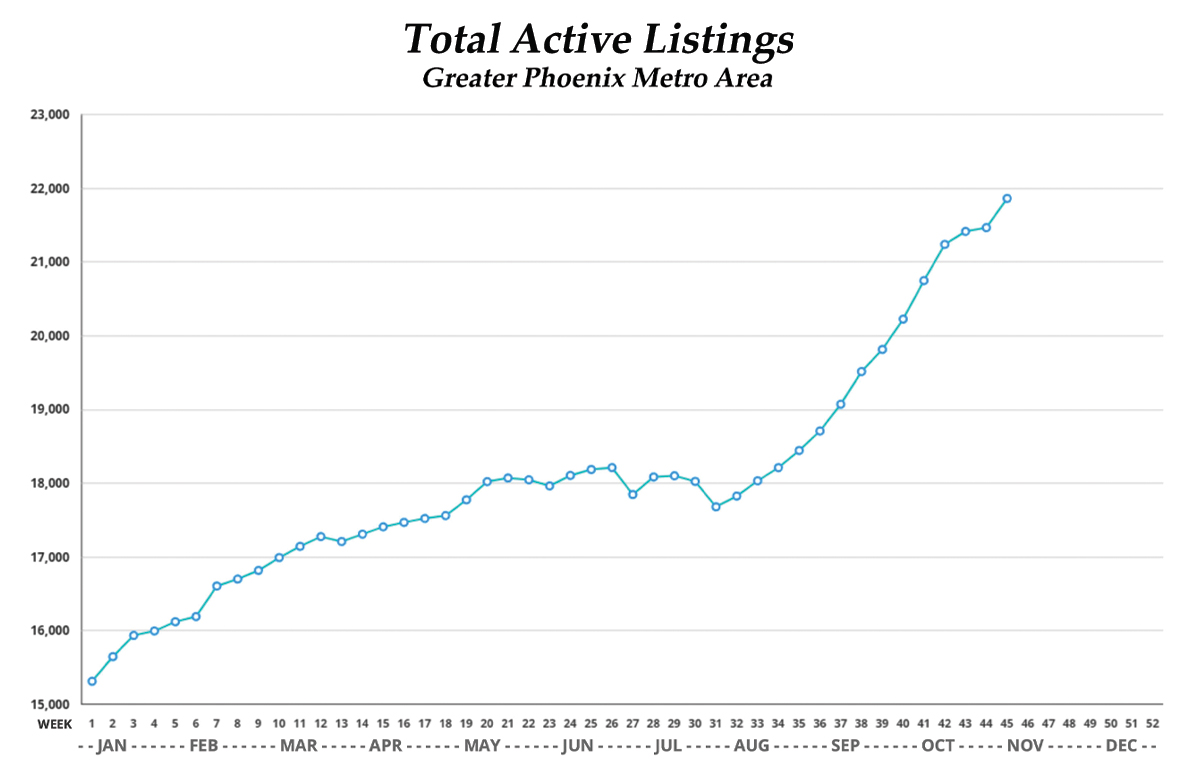

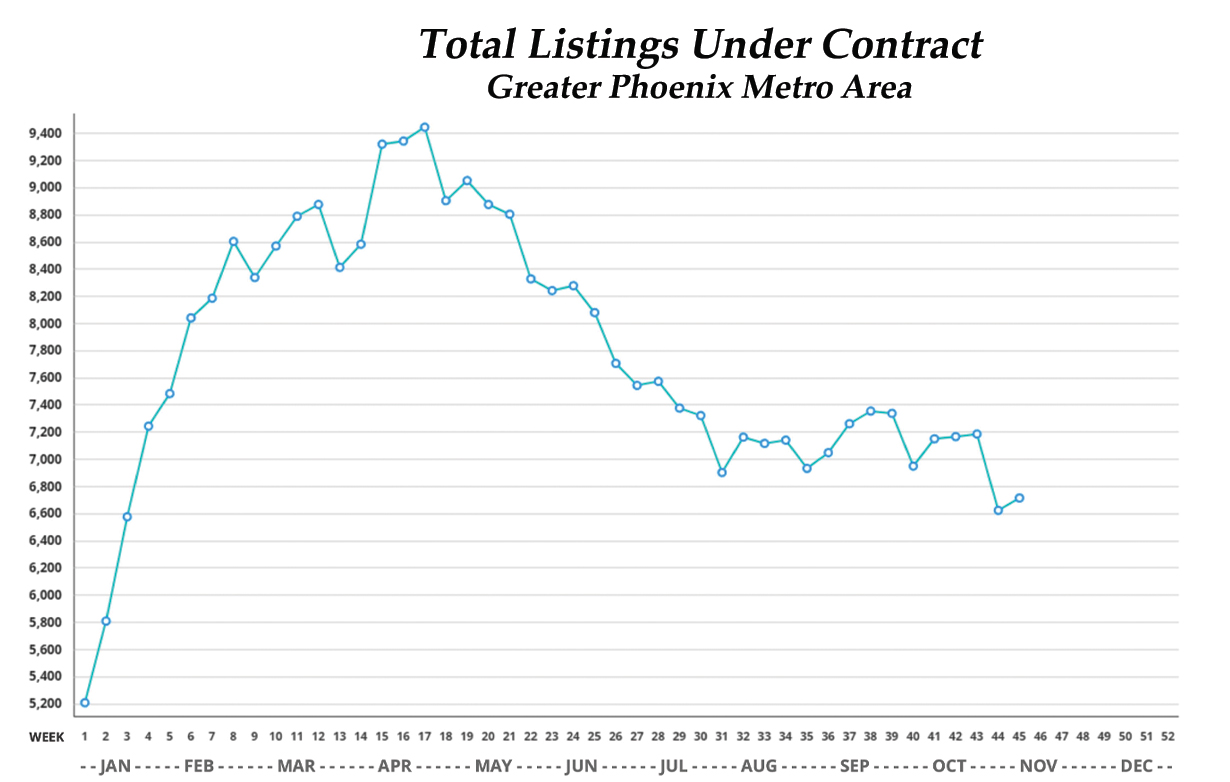

For the last couple of years as I’ve written in my newsletter about supply & demand a lot of focus has been paid to the demand side of the equation. This is for good reason, of course, because the high interest rate environment has greatly affected buyers ability or motivation to pay for the high cost of real estate, causing demand to fall to near record lows. Despite the extremely low levels of demand the market has remained stubbornly in balance, or in some areas even a mild, albeit quiet, seller’s market. The reason for this is because of how relatively low supply has remained, due in large part to very low mortgage rates enjoyed by most homeowners. Basically, people don’t want to trade their current 3% mortgage for a new 7% mortgage. Over the course of the last year, however, the active listing count in the Phoenix area has risen quite significantly, and this has contributed to the shifting balance of the market further in favor of buyers. In fact, out of the 17 major cities that make up the Greater Phoenix Area, 12 have shifted away from sellers over the last month. As of today’s writing, 7 are still in a sellers market, 5 are within balance, and 5 are now fully in buyer’s markets.

In January of this year there were just over 15k active listings in the Phoenix Metro Area. For context, a more “normal market” would have between 25-30k listings. This month, there are roughly 22k active listings, which is a nearly 43% increase and is the highest listing count since 2015. It’s important to note that this rise in inventory is not because of a rush of new listings, but rather an accumulation of listings because of how much longer it’s taking to market and sell a home. Typically, in the last two months of the year, sellers tend to be less likely to sell and will wait to list their home or will take their home off the market with plans to relist after the New Year or into the “spring selling season”. Consequently, we tend to see inventory decline this time of year. Interestingly, the beginning of November this year has brought a considerable spike in new listings. The reasons for this aren’t clear and it’s too early to call it a trend, but if this does continue, the shift towards a buyer’s market will also likely continue, especially because demand is still being suppressed by 7% interest rates.

As we head into the holidays and as families are deciding whether or not to make a move in the coming year and what their timeline might look like, it’s important to take all of these factors into consideration. Home prices have risen dramatically in the last decade, even taking into account the recent market correction. Home prices are dynamic, though, which means they also go down. As the market shifts further in favor of buyers, you can expect to see this reflected in the sales price of your neighbors homes, and thus affecting your value. It remains to be seen what will happen with the economy as the new administration takes over in January and I won’t begin to try to make any predictions, but I think it is unlikely that demand will pick back up in a meaningful way until mortgage rates settle to around 6% or less. Sellers should be prepared that their home will take longer to sell than they might like it to, and should also be conservative in their expectations for the sales price and ultimately their net proceeds. If you and your family are considering making a move in the next few months and would like to discuss your specific situation, please give me a call. I’d love to talk nerdy with you :)