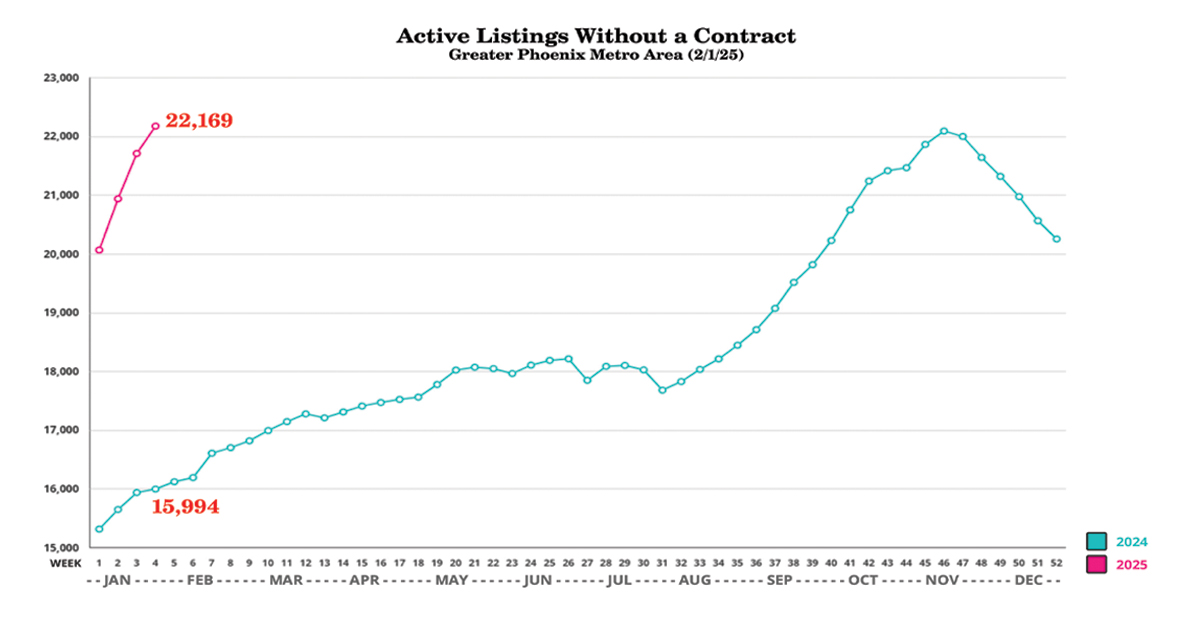

Today as I sit down to write this commentary I am in my office with coffee in hand staring at too many graphs and charts that tell only the beginning of the story that will ultimately be the 2025 housing market. It’s always a question to ponder on which key point and which takeaway best describes the most current moment in time… the snapshot of the metrics and the factors that are shaping the trajectory of one of the largest housing markets in the country. Today, it seems that housing supply is what stands out as being most salient and most deserving of our attention. One quick look at the graph below and you can see that there are many more for sale signs in our neighbor’s yards than there were last year this time. Throughout the last few years as we’ve braved the wilderness of high interest rates and a substantially slower market, the biggest saving grace has been our chronically low supply. This kept the market undersupplied despite the weakened demand, but this is changing quickly as inventory grows. As we talk about regularly, understanding the market begins and ends with understanding the balance of supply & demand. High mortgage rates and low demand is what has led the headlines and that part hasn’t changed much. As I explained in last month’s Year in Review edition, supply is now the side of the balance equation that is seeing the most significant change, having risen 33% throughout 2024, with the majority of that increase happening in the second half of the year. So, as we analyze this, it’s important to explain what specifically we’re looking at. It’s not simply the number of new listings being added to the market. What’s more telling is the rate at which they are being added.

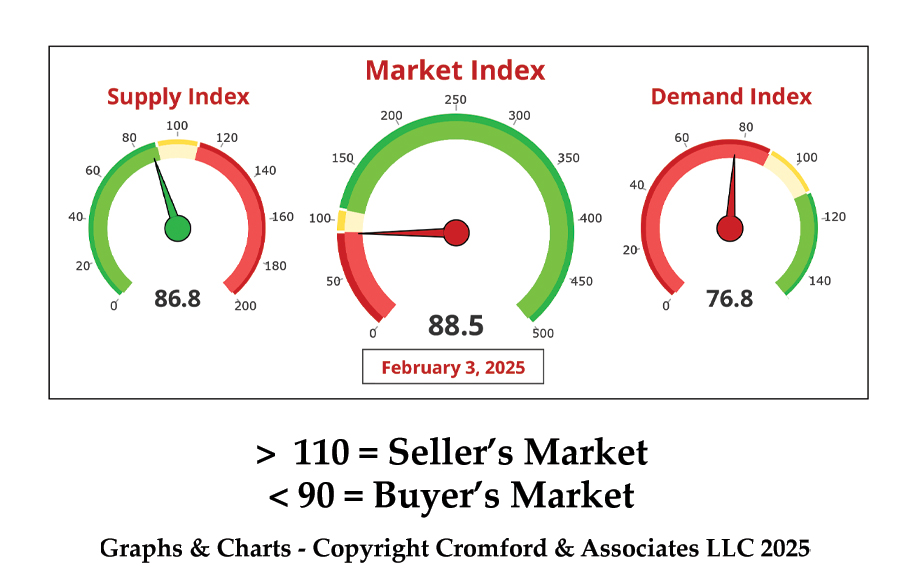

In the first four weeks of 2024, the number of homes for sale in the Greater Phoenix Metro area rose from 15,312 to 15,994 (less than 5%). During this same 4 week period in 2025, we began with an already higher base with 20,061 active listings and that has risen to 22,169, which is an increase of over 10% and more than 2,000 new listings. As we talk numbers, it’s always important to keep things in proper perspective, and so we should be reminded that a “normal market” has around 25k-30k listings. That being said, however, we should also be reminded that it’s again not about the number, it’s about the balance. Demand is, as we said, already quite weak and is not getting much stronger, so the more supply added to the market only pushes us further out of balance. Looking at our market index in the lower right, you can see that it reads 88.5, which is officially into buyer’s market territory (less than 90 is a buyer’s market, greater than 110 is a sellers market). It should be noted that all of these numbers are for the whole of the Phoenix Metro Area, which comprises 17 major cities and several other smaller cities. The reason we focus on the overall picture is because it gives us a broader context to understand the market. City-by-city, things look a bit different. For example, Peoria & Glendale are still currently in balance. Chandler, Scottsdale & Tempe are still in a relatively strong seller’s market, while Buckeye & Maricopa are in quite a dismal buyer’s market. Clearly, the outlying, lower-priced cities are struggling far more, as their more budget conscious buyers are more affected by interest rates.

There are many variables in the stew of factors that impact home values. We have myriad data points that help tell the ongoing story of the housing market, but it all still ultimately comes back to the principle of supply & demand. There are a lot of sweeping changes happening in Washington that will affect both sides of this balance. Until mortgage rates come down, buyers will likely remain sidelined, waiting to make a move until purchasing is more affordable. Tariffs and immigration reform could certainly increase costs and timelines to build new homes, which could again slow supply. This is why we must continue to pay attention and it is why I will continue to report on what we see on the ground level and what the data tells us from 30,000 feet above. If you are considering buying or selling a home anytime in the near future, please give me a call and we can discuss your specific situation. I’d love to talk nerdy with you :)