As crazy as it is to say, we’re already approaching the halfway point in the year, so I thought it would be a good time to give a quick “big picture” update on how the market has been doing so far and what we might have in store for the second half of the year. As always, the answer isn’t quite as straightforward as it would seem or we might like it to be. The simple answer that I tend to give is that overall our market remains healthy, it’s just very quiet. In spite of the higher interest rates, buyers are still buying homes. While high, the interest rates have at the very least remained relatively stable between 7 to 7.5 percent for the last several months, and most buyers have accepted that they are going to have to pay a higher rate in the short term. However, they are also enjoying having more choices than they’ve had in quite a while, and with much less pressure to write offers quickly for the fear of losing the home to a competing buyer. While we are not adding an excessive amount of new listings to the market each month, our inventory is on the rise, as most listings are sitting for longer without a contract. Sellers are competing more directly with the new home builders, but should be happy to see that prices are rising again. Sellers should also be prepared for fewer weekly showings, and in effect for it to take longer for their home’s to sell. In addition, while sellers are receiving higher prices, like the builders, they should also be prepared to pay more in concessions to buyers, such as helping to buy down their interest rate, pay for home warranties, etc. In short, while it is indeed quiet, we’re really in a more normalized market than we’ve seen in years, where both buyers and sellers have the ability to negotiate. Neither buyer nor seller have such power that they can get everything that they want while the other side has to capitulate on every point. This, in my opinion, has been one of the positives of the market shift.

Given the current political climate with the upcoming presidential election, there remains a decent level of uncertainty with a mix of optimism and pessimism about the economy on the whole. We’ve been hearing for some time now that the Federal Reserve could cut rates in the second half of the year, but that remains to be seen. If or when rates do come down, we could very possibly see a surge of active buyers that have been sidelined, and we could quickly burn through the relatively weak supply. This, in turn, would push the balance further in favor of sellers… but this again all remains to be seen. Some doomsaying YouTubers out there are still suggesting that a massive market crash is imminent, but the end of the world has been predicted many times over and yet we still stand and the world is still turning. The wave of foreclosures that they keep anticipating and that their argument is predicated upon hasn’t happened and, in fact, our rate of foreclosures is lower than it was before the pandemic. This particular end of the spectrum about the forecast for the market seems misguided and the data doesn’t support their assertions, and isn’t one I would spend much energy on.

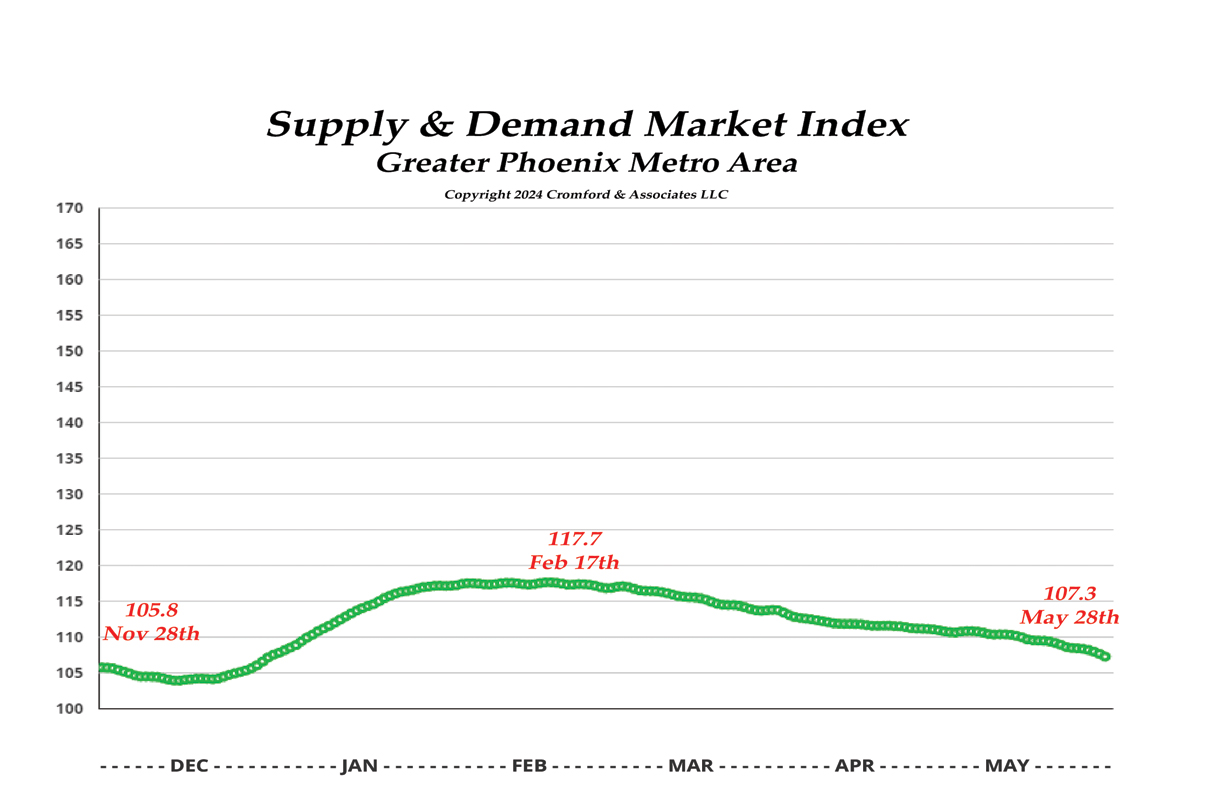

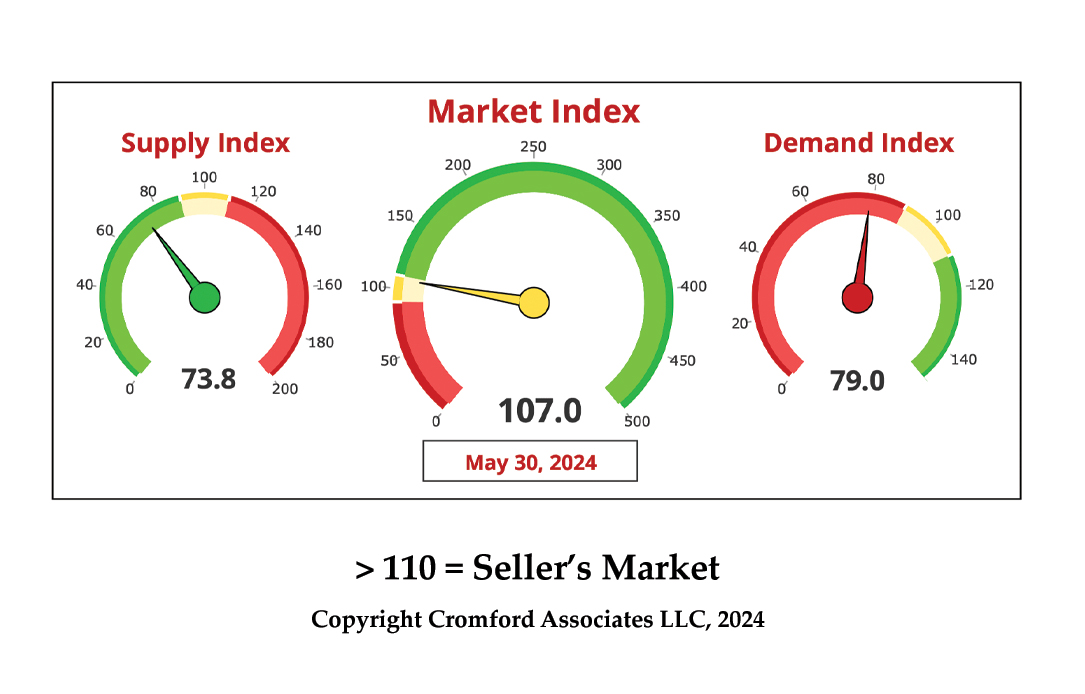

As of today, 11 out of the 17 major cities within the Greater Phoenix Metro Area are still in a seller’s market, and only 3 are in a buyer’s market. Our market index has been cooling for a few months now, so we do expect the balance to continue to shift towards buyers, but nothing suggests a dramatic shift one way or the other in the near-term. We have seen an increase in price reductions for active listings and these reductions could lead to weaker prices in the coming months. To sum it all up, I feel optimistic about the overall picture and near-term forecast of the market and think that conditions will continue to improve, albeit very slowly. If you are thinking of possibly selling your home or buying a new one in the next few months, please feel free to reach out and we can discuss your specific situation. I’d love to talk nerdy with you :)