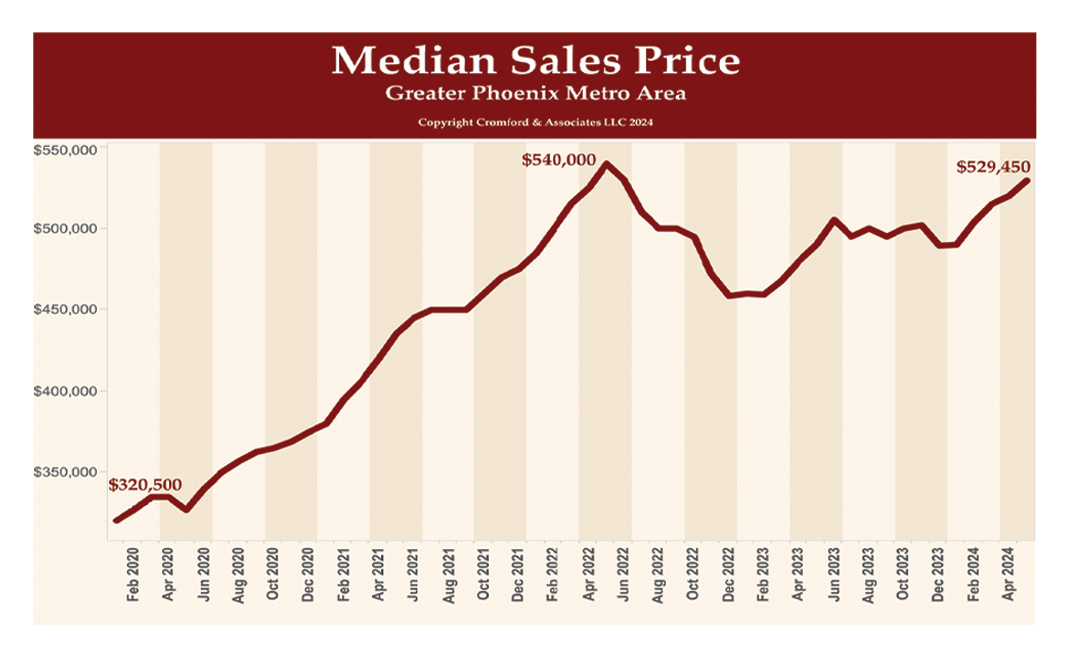

A lot of market commentary over the past couple of years, including my own, has focused quite a bit on the rising interest rates, and for good reason. We’ve also talked extensively about the effect these higher rates have had on buyer demand and the market on the whole. All of this might lead you to believe that our market has been in a real slump and that housing prices would be continuing to fall. If you were talking about the second half of 2022, you would be correct. If, however, you look at the data and what has transpired since the initial reaction to the market change, you can see that our prices have done anything but drop. In fact, you can see that as of this month, our median sales price across the Greater Phoenix Metro Area has risen nearly back to where we peaked in May of 2022. Additionally, the average price per square foot has now officially exceeded the peak of 2022, currently sitting at just over $308 per foot.

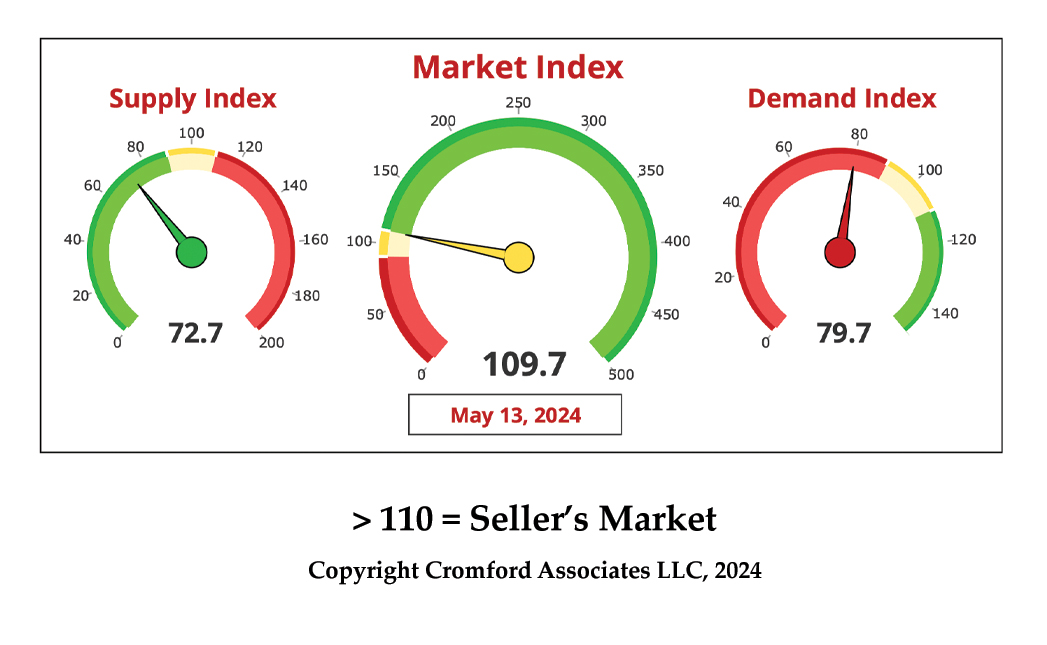

You may be wondering how this can be if demand has been so low for the last couple of years. To understand it, we must turn back to our trusty market index, which again shows us the balance of supply and demand. If you will recall from the latter half of 2022, our market index was in free fall, plummeting from a high of over 500 as new listings flooded the market and demand dropped to the floor. This was what I wrote about in the “year in review” edition back in January of 2023. We were flying high and then when the Fed started jacking up interest rates and the market shifted rapidly, we had a soft landing right into a balanced market, having only slipped into a buyers market for a mere three weeks before bobbing back up into balance. The primary reason for the rapid rise in new listings during that period was panic, and mostly from investors and big home buying companies like Opendoor, Offerpad, and Zillow. These companies were playing a dangerous, shortsighted game of buying properties over-value during the boom of the market in an effort to gain market share, only to turn around and take massive losses when they had to fire-sell them to keep from drowning in their excessive inventory. As these companies price reduced, it caused neighboring listings to reduce in response to keep from appearing overpriced by comparison. Fortunately, this race to the bottom only lasted about 6 or 8 months. As the panic subsided and buyers and sellers began to realize that we might just be okay after all, the market began to stabilize. Those buyers that were in need of making a move started to realize that 6-7%interest rates were not going to go away anytime soon, and bit the bullet to move forward with purchasing. As demand rose, even marginally, the accumulated inventory began to be absorbed quite quickly and we again found ourselves with not enough inventory to adequately supply even the relatively low demand. This, in turn, caused values to climb to where we are today.

We are not quite at the midpoint in the year so it’s a bit hard to say how the rest of the year will shake out, but the majority of the 17 major cities that make up the Phoenix area are seeing improvement week over week. It’s another big election year, so there are a lot of other variables at play that could affect the overall market It does seem clear that the housing market has been stubbornly and remarkably resilient in the face of this inflation driven interest rate environment. There are a lot of very real reasons people continue to move to the Phoenix area, and with so many current homeowners enjoying such low interest rates on their existing mortgages and unwilling to exchange that for a higher rate, it seems unlikely that supply will significantly outpace demand. There are many indications that inflation is subsiding and will continue to do so, which should result in lower rates in the later months to come. With this, we anticipate that the buyers that have been waiting will get back in the game and demand will pick back up. So, while the market is dynamic and hard to predict, I feel optimistic that values will continue to rise for some time. If you are considering buying or selling anytime in the near future and would like to discuss your specific situation, please give me a call. I’d love to talk nerdy with you :)